Startup Advisory & Business Consulting in India

For Founders Who Want to Build Right, Not Just Fast

Building a startup in India is easier than ever. Building a credible one is not.

Between incorporation, compliance, funding pressure, regulatory uncertainty, and investor expectations, most founders are forced to make decisions before they fully understand the consequences. This is where a startup business consultant in India plays a critical role. Not as a cheerleader. As a thinking partner.

At D2RGC, our startup advisory and business consulting practice is designed for founders who want clarity before speed and structure before scale.

What Startup Advisory Really Means (And What It Doesn’t)

Startup advisory is often misunderstood.

It is not:

- Generic mentorship

- Slide decks with buzzwords

- One-off advice without accountability

Real startup advisory is about decision quality.

A credible startup advisor in India helps founders:

- Ask the right questions early

- Avoid structural mistakes that surface later

- Build investor and regulatory confidence over time

According to the Startup Genome Global Startup Ecosystem Report, over 90% of startup failures are linked to execution and decision-making gaps, not lack of ideas. Advisory exists to reduce that risk.

Source: Startup Genome Report

Why Founders in India Need Structured Advisory Support

India’s startup ecosystem is mature. Regulations, investors, and customers expect seriousness earlier than before.

Key challenges founders face today include:

- Complex compliance environments (especially in regulated sectors)

- Pressure to show traction before systems are ready

- Poor alignment between product, regulation, and go-to-market

- Founder-led decision overload

This is why startup business consulting in India has evolved beyond strategy decks into execution-aware advisory.

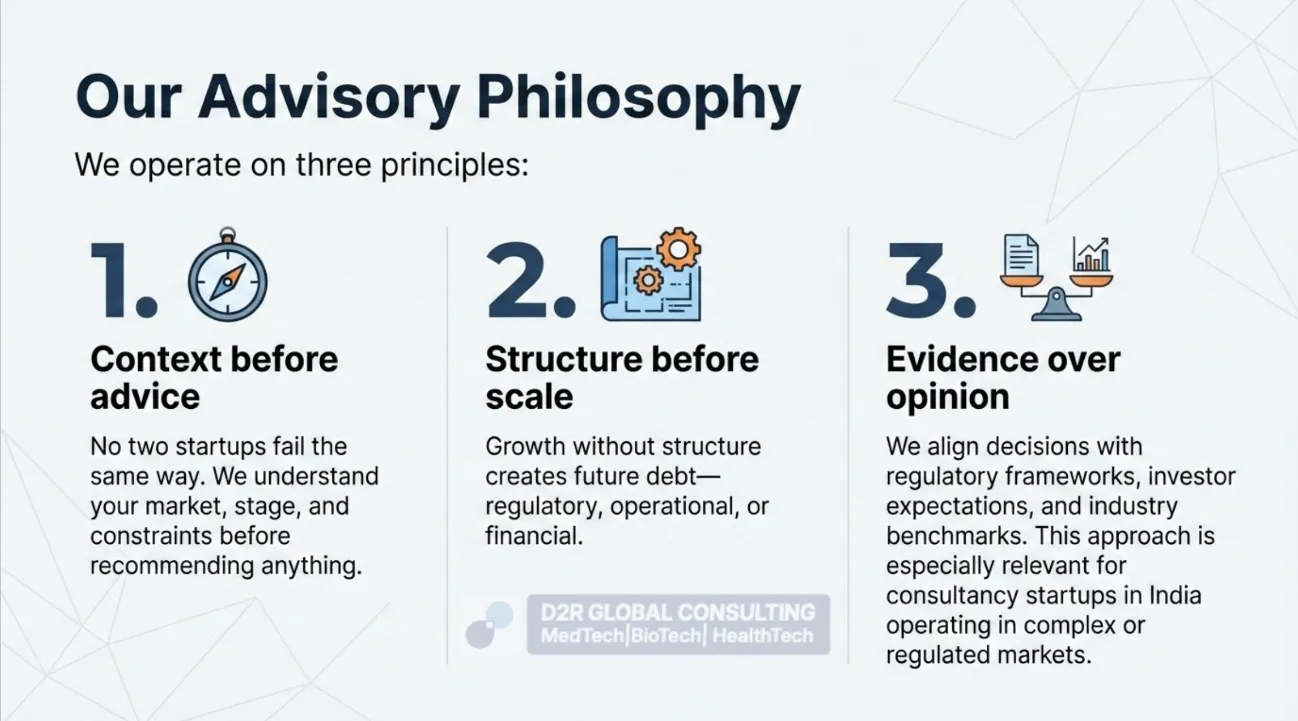

Our Advisory Philosophy

We operate on three principles:

1. Context before advice

No two startups fail the same way. We understand your market, stage, and constraints before recommending anything.

2. Structure before scale

Growth without structure creates future debt—regulatory, operational, or financial.

3. Evidence over opinion

We align decisions with regulatory frameworks, investor expectations, and industry benchmarks. This approach is especially relevant for consultancy startups in India operating in complex or regulated markets.

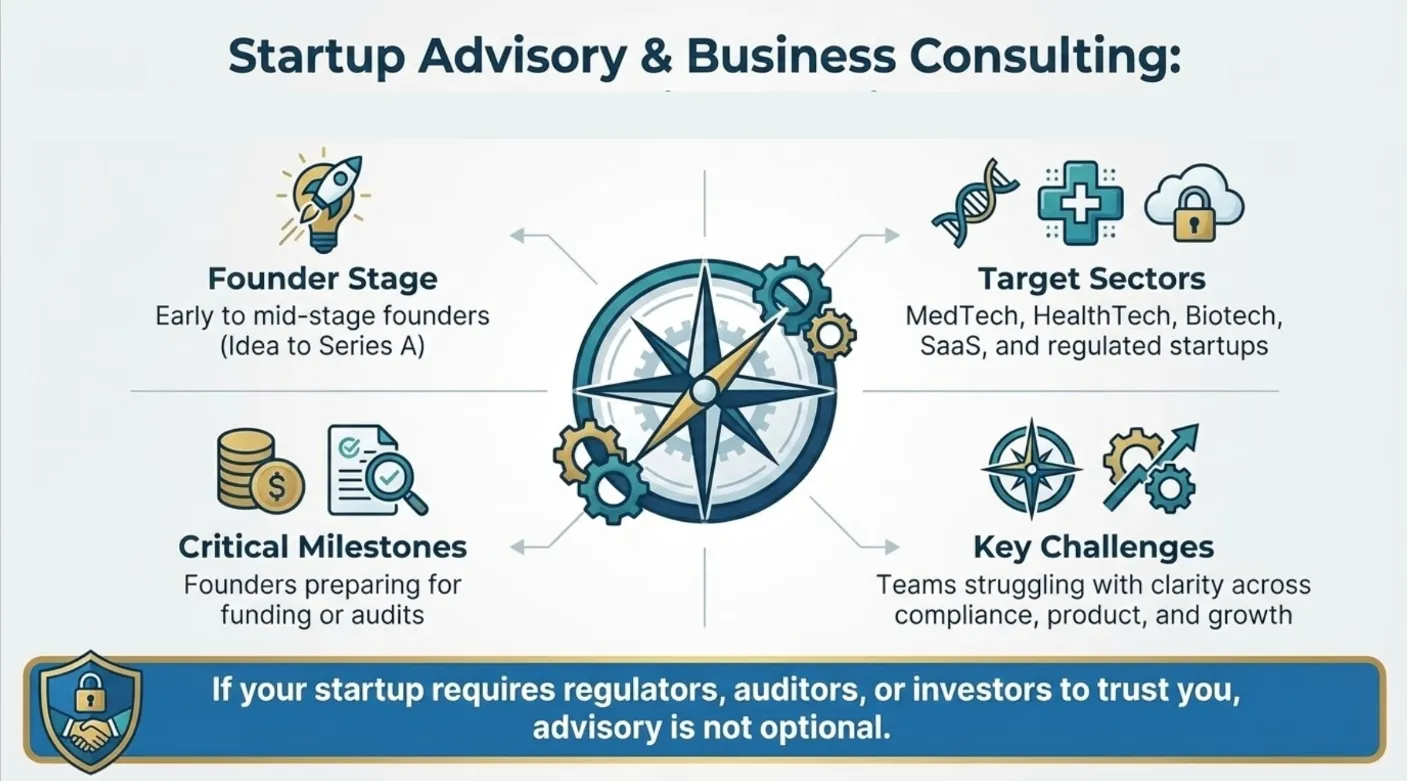

Who This Advisory Is For

Our startup advisory & business consulting services are best suited for:

- Early to mid-stage founders (Idea to Series A)

- MedTech, HealthTech, Biotech, SaaS, and regulated startups

- Founders preparing for funding or audits

- Teams struggling with clarity across compliance, product, and growth

If your startup requires regulators, auditors, or investors to trust you, advisory is not optional.

Advisory Areas We Cover

1. Founder Decision Advisory

Founders often operate with incomplete information. We help you:

- Prioritise decisions that matter now

- Defer decisions that don’t

- Avoid irreversible structural mistakes

This includes market entry sequencing, product readiness vs regulatory readiness, and timing your hiring to bridge capability gaps.

Harvard Business Review highlights that startups with advisory support outperform peers in strategic decision quality and capital efficiency. (Source: HBR)

2. Business & Operating Model Clarity

We work with founders to align their business model, regulatory obligations, cost structures, and revenue pathways.

This is where many management consulting startups in India fail. They treat business models in isolation. We don’t. Your model must survive compliance scrutiny, investor due diligence, and market adoption.

3. Regulatory & Risk-Aware Advisory

For regulated startups, poor advice is expensive. Our advisory integrates regulatory pathways, compliance timelines, and risk mitigation strategies.

We align advisory with frameworks such as:

- ISO 13485

- FDA and CDSCO expectations

- SaMD and digital health guidelines

Learn more about our Startup Support Services

4. Funding & Investor Readiness Advisory

Investors do not fund potential. They fund preparedness. We advise founders on when to raise, what gaps investors will flag, and how to prepare for due diligence.

According to CB Insights, regulatory and operational readiness is among the top hidden reasons deals fall through.

Source: CB Insights

5. Transition from Founder-Led to System-Led Operations

As startups grow, founder control becomes a bottleneck. Our advisory supports governance setup, decision delegation frameworks, and board/advisor readiness. This is critical for startups planning scale or acquisition.

How Our Advisory Is Different from Typical Consulting

Most startup consultancy firms in India offer advice disconnected from execution. We don’t.

Our advisory is:

- Grounded in regulatory and operational reality

- Backed by execution teams

- Designed to evolve with your stage

This makes our advisory practical, not theoretical.

Advisory for Regulated & Deep-Tech Startups

Regulated startups face unique risks including regulatory delays, documentation gaps, audit failures, and investor hesitation.

Our advisory integrates with QMS and documentation frameworks, pre-compliance planning, and audit preparedness. (Relevant reading: ISO 13485 Overview)

Why Advisory Is a Long-Term Asset

Good advisory compounds.

It reduces: Rework, regulatory surprises, and funding delays.

It increases: Decision confidence, investor trust, and long-term valuation.

This is why advisory is increasingly seen as a core capability, not a luxury.

Common Mistakes Founders Make Without Advisory

- Over-engineering too early

- Under-preparing for audits

- Hiring before defining roles

- Chasing funding before readiness

- Treating compliance as a checkbox

Each mistake costs time. Some cost the company.

When Should You Engage a Startup Advisor?

You should consider advisory if:

- You’re unsure about regulatory or compliance implications

- Investors are asking uncomfortable questions

- Growth feels chaotic, not structured

- Decisions feel reactive, not planned

The earlier you engage, the cheaper the correction.

Final Word

A startup advisor’s job is not to tell you what you want to hear. It is to help you avoid decisions you’ll regret later.

If you’re looking for a startup business consultant in India who understands regulation, execution, and investor reality, we should talk.

Related Resources:

Comments are closed